Navigating the Waves: Comprehensive Wave Accounting Help for Small Businesses

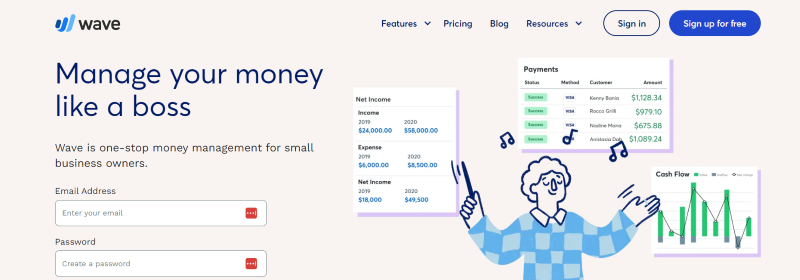

Wave Accounting is a popular, free accounting software specifically designed for small businesses, freelancers, and entrepreneurs. While its user-friendly interface and no-cost model make it an attractive option, users often encounter challenges that require seeking Wave Accounting help. This article provides a comprehensive guide to understanding and resolving common issues, optimizing your Wave Accounting experience, and leveraging its features to manage your business finances effectively. Whether you’re a seasoned business owner or just starting, understanding how to access and utilize Wave Accounting help resources can significantly streamline your financial management.

Understanding Wave Accounting: A Quick Overview

Before diving into troubleshooting and seeking Wave Accounting help, it’s essential to understand the core functionalities of the platform. Wave offers features such as:

- Invoicing: Creating and sending professional invoices to clients.

- Expense Tracking: Recording and categorizing business expenses.

- Accounting: Managing your chart of accounts, journal entries, and financial reports.

- Payments: Processing online payments from customers directly through invoices.

- Payroll (Add-on): Paying employees and managing payroll taxes (available in select regions).

Knowing how these features work independently and together is crucial for effective financial management and knowing when and where to seek Wave Accounting help.

Common Wave Accounting Challenges and Solutions

Despite its user-friendly design, users frequently encounter specific challenges. Here’s a breakdown of common issues and how to find Wave Accounting help to resolve them:

Invoice Issues

Problem: Invoices not sending, incorrect calculations, or issues with customization.

Solution:

- Check your internet connection: Ensure a stable connection for sending invoices.

- Verify invoice details: Double-check quantities, rates, and taxes.

- Customize invoice templates: If the issue relates to appearance, explore Wave’s customization options in settings.

- Contact Wave Support: If the problem persists, reach out to Wave’s customer support team for specific Wave Accounting help.

Expense Tracking Problems

Problem: Difficulty categorizing expenses, missing transactions, or issues with bank feeds.

Solution:

- Review expense categories: Ensure you’re using the appropriate categories for your expenses.

- Manually add missing transactions: If a transaction isn’t imported automatically, manually add it.

- Troubleshoot bank feeds: Disconnect and reconnect your bank feed to resolve potential syncing issues. Look for tutorials or Wave Accounting help articles on connecting bank feeds.

- Reconcile regularly: Regularly reconcile your bank statements with Wave to identify and correct discrepancies.

Accounting and Reporting Errors

Problem: Incorrect financial reports, unbalanced accounts, or difficulty understanding accounting principles.

Solution:

- Review your chart of accounts: Ensure your chart of accounts is set up correctly and reflects your business activities.

- Consult with a bookkeeper or accountant: For complex accounting issues, consider seeking professional Wave Accounting help from a qualified bookkeeper or accountant.

- Utilize Wave’s reporting features: Generate various reports (e.g., profit and loss, balance sheet) to analyze your financial performance.

- Refer to Wave’s knowledge base: Wave offers extensive documentation and tutorials on accounting principles and reporting.

Payment Processing Issues

Problem: Issues with accepting payments, transaction errors, or problems with payout schedules.

Solution:

- Verify payment gateway settings: Ensure your payment gateway is properly connected and configured.

- Check transaction details: Double-check the amount and customer information for any errors.

- Contact Wave Payments Support: For issues specific to payment processing, contact Wave’s payments support team for dedicated Wave Accounting help.

- Understand payout schedules: Familiarize yourself with Wave’s payout schedules to anticipate when funds will be deposited into your account.

Payroll Challenges (If Applicable)

Problem: Difficulties with calculating payroll taxes, managing employee information, or generating pay stubs.

Solution:

- Ensure accurate employee information: Verify that all employee information (e.g., addresses, tax identification numbers) is accurate and up-to-date.

- Consult with a payroll specialist: For complex payroll issues, seek professional Wave Accounting help from a payroll specialist.

- Utilize Wave’s payroll features: Leverage Wave’s built-in tools for calculating payroll taxes and generating pay stubs.

- Stay updated on payroll regulations: Keep abreast of changes in payroll laws and regulations to ensure compliance.

Where to Find Wave Accounting Help: A Comprehensive Resource Guide

When you encounter a problem, knowing where to find reliable Wave Accounting help is crucial. Here’s a breakdown of available resources:

Wave’s Help Center

The Wave Help Center is your first stop for finding answers to common questions. It features a comprehensive knowledge base with articles, tutorials, and FAQs covering a wide range of topics. You can search for specific keywords or browse by category to find relevant information. This is an excellent resource for self-service Wave Accounting help.

Wave Community Forums

The Wave Community Forums provide a platform for users to connect, share tips, and ask questions. You can post your questions and receive answers from other Wave users, as well as Wave support staff. This can be a valuable resource for getting real-world advice and solutions to specific problems. It’s also a great place to learn about best practices and discover new ways to use Wave. This is where you can get peer-to-peer Wave Accounting help.

Wave Support Team

If you can’t find the answer you need in the Help Center or Community Forums, you can contact the Wave Support Team directly. They offer support via email and chat, depending on your subscription plan. Be prepared to provide detailed information about your issue, including screenshots or error messages, to help them understand the problem and provide effective Wave Accounting help.

Third-Party Resources

Numerous third-party resources offer Wave Accounting help, including:

- Bookkeepers and Accountants: Many bookkeepers and accountants specialize in Wave Accounting and can provide personalized support and guidance.

- Online Courses and Tutorials: Platforms like Udemy and YouTube offer courses and tutorials on using Wave Accounting effectively.

- Blog Posts and Articles: Many websites and blogs publish articles and guides on Wave Accounting, offering tips and tricks for optimizing your experience.

Tips for Maximizing Your Wave Accounting Experience

Beyond seeking Wave Accounting help when issues arise, proactively optimizing your use of the software can prevent problems and enhance your financial management. Here are some tips:

- Regularly Reconcile Your Accounts: Reconciling your bank and credit card accounts regularly helps identify and correct discrepancies, ensuring accurate financial records.

- Automate Bank Feeds: Setting up automated bank feeds streamlines the process of importing transactions, saving time and reducing the risk of errors.

- Utilize Expense Categories Effectively: Properly categorizing your expenses provides valuable insights into your spending patterns and helps you track your profitability.

- Customize Invoices: Creating professional-looking invoices with your branding can enhance your business image and improve customer satisfaction.

- Take Advantage of Reporting Features: Regularly generating and analyzing financial reports provides valuable insights into your business performance and helps you make informed decisions.

- Back Up Your Data: While Wave automatically backs up your data, it’s always a good idea to create your own backups periodically to protect against data loss.

- Stay Updated with Wave’s New Features: Wave regularly releases new features and updates, so stay informed about these changes to take advantage of the latest improvements.

Leveraging Wave Accounting for Long-Term Financial Success

Wave Accounting help is not just about fixing problems; it’s about empowering you to leverage the software for long-term financial success. By understanding its features, utilizing available resources, and proactively optimizing your use of the platform, you can streamline your financial management, gain valuable insights into your business performance, and make informed decisions that drive growth and profitability. Mastering Wave accounting features, including invoicing, expense tracking, and financial reporting, contributes significantly to the overall financial well-being of your small business. This knowledge enables you to make informed decisions and plan for the future, ensuring that your business remains financially stable and competitive.

In conclusion, while Wave Accounting offers a user-friendly and cost-effective solution for small business accounting, understanding how to access Wave Accounting help is essential for navigating potential challenges and maximizing its benefits. By utilizing the resources outlined in this article, you can confidently manage your finances and focus on growing your business. Remember to leverage Wave’s resources, community support, and when necessary, professional bookkeeping or accounting services to ensure your financial processes are accurate, efficient, and contribute to your business’s overall success. [See also: Small Business Accounting Software Comparison] [See also: Best Practices for Invoice Management] [See also: Understanding Financial Statements for Small Businesses]